New Gst Tax Code Malaysia 2016

Gst on import of goods.

New gst tax code malaysia 2016. On 7 march 2016 the yang di pertuan agong abdul halim congratulated the government for implementing gst. Our main office is located in klang selangor malaysia. New gst tax codes introduced in august 2016.

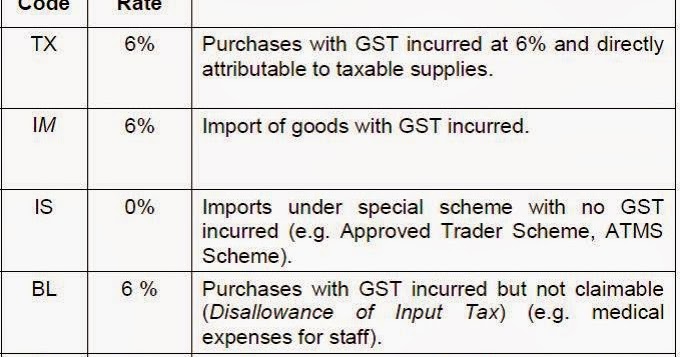

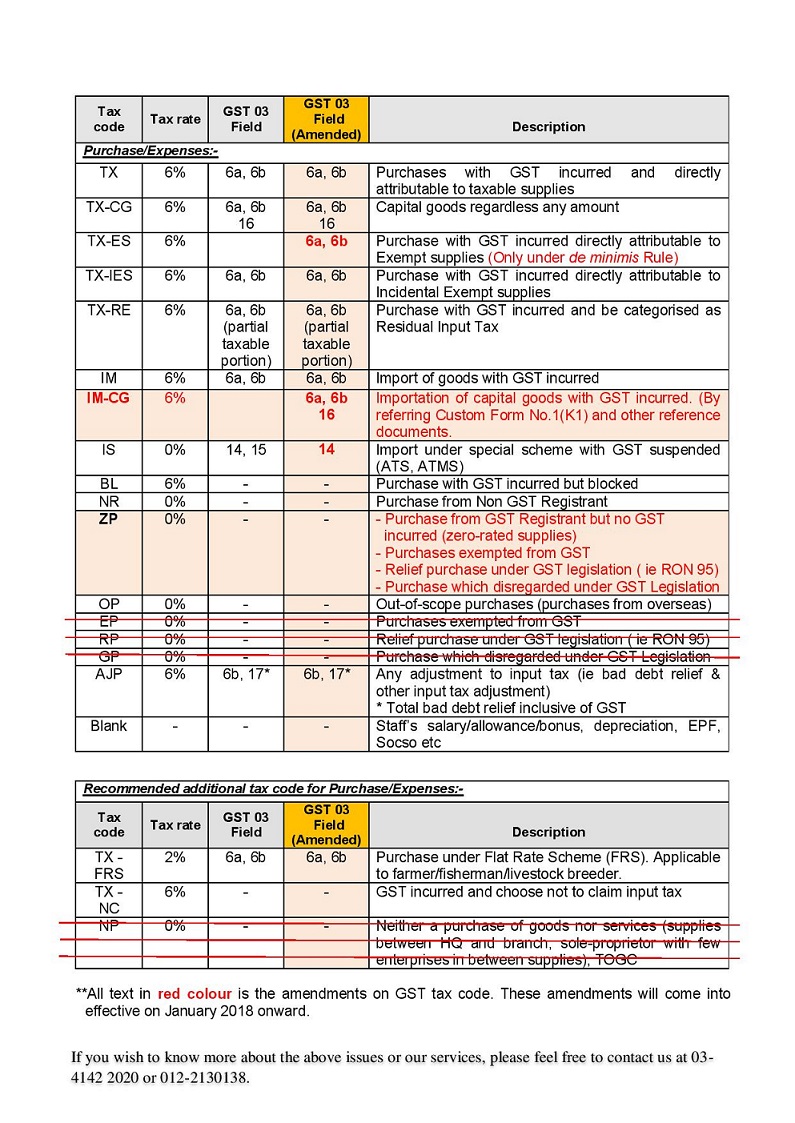

Relief purchase under gst legislation purchase of ron 95 or diesel 0 new tax code. From the newly implemented gst managed to supplant malaysia s national budget from the deficit induced by a loss in oil tax revenue. Gst code description rate gst 03 fields.

The gst amount must be shown on the tax invoice otherwise the registered person is not allowed to claim input tax using the tax invoice. The total value of other supplies includes out of scrap supplies and disregarded supplies. Purchases from farmers or fishermen registered under the flat rate scheme.

I had incurred plant and machineries in june 2016. For purchase of goods and services that are given relief under gst for example purchase of ron95 petrol. The goods and services tax gst.

Aesoft technology solutions gst tax code for malaysia aug 18 2016 selangor malaysia kuala lumpur kl supplier suppliers supply supplies aesoft technology solutions is a one stop pos system and related hardware supplier company. Published on aug 3 2016 sql account new gst features in version735 are introduction of new tax codes change of tax codes and also generating gaf 2 0 based on malaysia kastam guideline release on. Gst on purchases directly attributable to taxable supplies.

This guide also provides guidance to gst registrant that used any accounting software for their businesses. This tax code refer to purchase with gst incurred for all capital goods acquired that is claimable regardless the value of the goods. Approved trader scheme atms scheme.

6a 6b and 16. Gst code rate description. Purchase of fixed assets with gst.

Guide on accounting software enhancement towards gst compliance as at 20 july 2016 3 able to comply with the gst legislation. Purchases with gst incurred but not claimable disallowance of input tax e g. Imports under special scheme with no gst incurred e g.

Therefore the tax invoice must fulfill the prescribed particulars based on gst legislations. All the information and recommendation as prescribed in this guide such as tax code for purchase supply mapping of gst tax codes with gst 03 return and gst reports in form of gaf will ensure better gst compliance for. From the taxable period january 2018 onwards item 15 of gst 03 return has been amended from total value of gst suspended under item 14 to total value of other supplies.

My company become registered for gst in march 2017. The new guide withdraws the tax code np and reinstate tax code im cg. Ii credit note debit note a person made or received a supply shall issue a credit note or debit.

By may 2018 the new malaysian government led by mahathir mohamad decided to reintroduce the sales and services tax.