Non Allowable Expenses In Taxation Malaysia

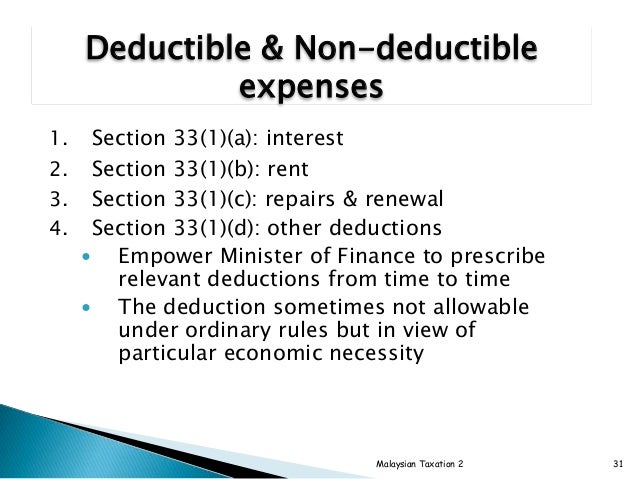

Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross income.

Non allowable expenses in taxation malaysia. Such include any disbursements or expenses not being. And if you deduct an expense that doesn t qualify you might be faced with a tax notice or tax audit. Knowing what expenses are not tax deductible might help company to minimise such expenses.

Inland revenue board of malaysia entertainment expense public ruling no. Personal expenses example. Taxavvy issue 4 2017 2 guideline on deduction for expenses relating to secretarialand tax filing fees the inland revenue board irb has issued its guideline dated 8 february 2017 on the tax deductionof secretarial and tax.

For petroleum operations by virtue of section 13 1 a to j of ppta for the purpose of ascertaining the adjusted profit of a company in an accounting period deductions shall not be allowed in respect of some disbursements or payments. Guidelineon deductionfor expenses relatingto secretarial and tax filingfees guidelinefor submission of tax estimates under section 107c of the incometax act 1967. Epf payment rental of business premise interest on business loan.

2018 2019 malaysian tax booklet 18 b there was no material omission or misrepresentation in or in connection with the application of the ruling. Companies are taxed at the 24 with effect from year of assessment 2016 while small scale companies with paid up capital not exceeding rm2 5 million are taxed as follows. Certain expenses have often been refused a tax deduction even though for businessman they are regarded as necessary business costs.

Expenses for repair of premise and vehicles used for business purpose. Corporate income tax in malaysia is applicable to both resident and non resident companies. Double deduction expenses allowable under income tax act 1967.

4 2015 date of publication. It is frequently unclear whether a certain tax expense might qualify as a tax deduction or not. Where a borrowing is partly used to finance non business operations the proportion of interest expense will be allowed against the non business income.

The following are more common non allowable expenses. The tax treatment of entertainment expense as a deduction against gross income of a business. Or d the taxpayer fails to satisfy any of the conditions stipulated by the dgir.

Expenses that are not incurred. Payment for wages salary. Expenses incurred in the production of income example.

C the assumptions made by dgir when issuing the advance ruling are subsequently proved to be incorrect. Allowable and not allowable company expenses for tax purposes 3 businessday sep 10 2014. For deductibility of interest.

Fortunately there are many deductible tax expenses that exist so you may be surprised that your tax expense of choice qualifies for a tax deduction. 2018 2019 malaysian tax booklet income tax. 29 july 2015.

Nondeductible tax deductions expenses. Allowable and disallowable expenses allowable expenditure disallowable expenditure staff related costs not wholly exclusively incurred for trade employers nic your own wages salary or drawings insurance the initial cost of buildings rents council tax relating to the private use heating lighting rates of your home security alterations improvements to business general maintenance of.

.jpg)