Non Taxable Income Malaysia

There are no other local state or provincial.

Non taxable income malaysia. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Malaysia taxes both residents and nonresidents only on income derived from a malaysian source or received in malaysia. Generally it is 60 days.

The income is classified into 8 different tax groups ranging from 0 to 26. An individual will be considered non resident for income tax purpose if the individual is physically present in malaysia for less than 182 days during the calendar year regardless of the citizenship or nationality. You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents.

If you are a foreigner employed in this country you must give notice of your chargeability to the non resident branch or the nearest irbm branch within 2 months of your arrival in malaysia. You are regarded as a non resident under malaysian tax law if you stay in malaysia for less than 182 days in a year regardless of nationality. If you do not receive the income in malaysia and it is not derived from a source in malaysia you are not subject to taxes on the income in malaysia.

No other taxes are imposed on income from petroleum operations. In malaysia the income tax rate for residents is calculated on the amount of income and is much more precise. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

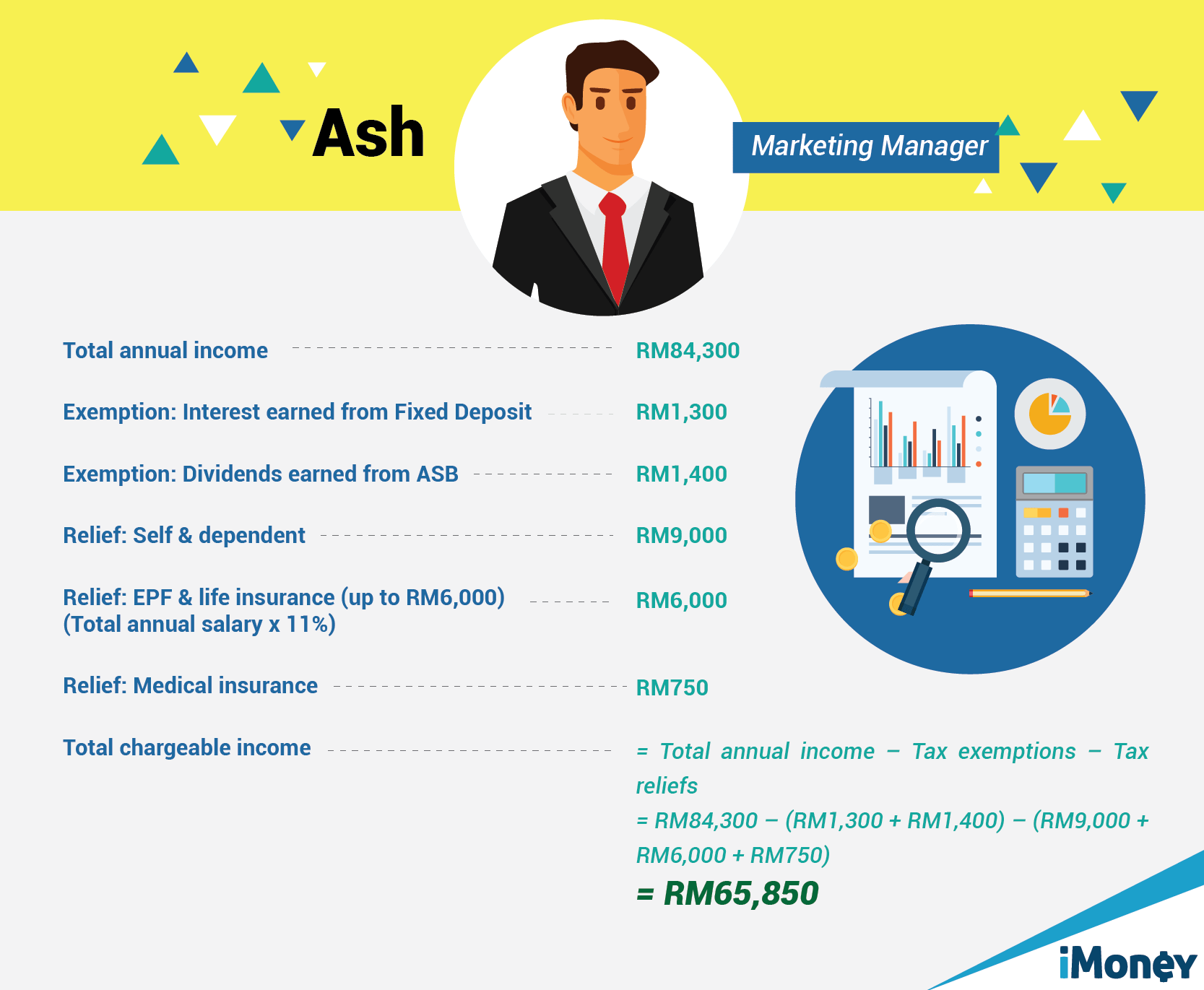

Most malaysians are familiar with tax reliefs which you can file as income that won t get taxed because you spent them on certain types of expenses. However the income tax of non residents is calculated on a three step tax rate 27 15 and 10 depending on the type of income. Under the malaysian tax law the income of a non resident individual from an employment exercised by them in malaysia for no more than 60 days in total in a basis year will be exempt from malaysian tax.

The 182 days period can be consucative period or not. But you might not have known that there are also tax exemptions in the law which are basically types of income that you pay 0 tax on.